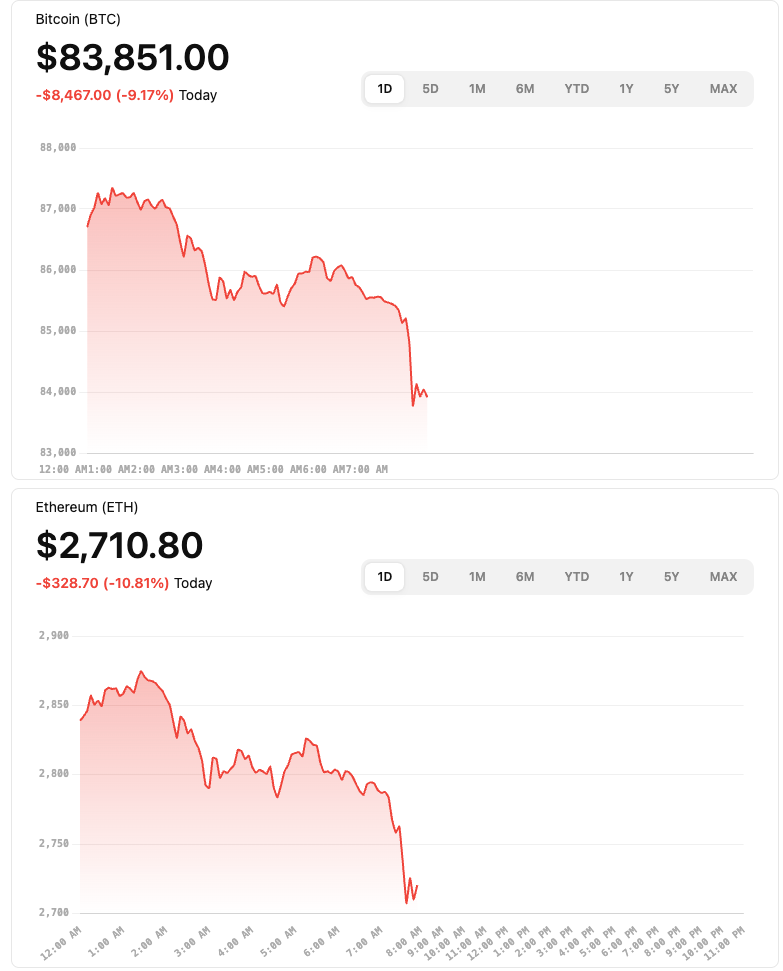

2025-11-21 A significant drop for Bitcoin and Ethereum

The drop doesn’t necessarily mean crypto is done for—many analysts view this as a correction rather than the end of the cycle.

With interest-rates still elevated and fewer eyes on imminent rate cuts by Federal Reserve, the “risk asset” premium for crypto is being squeezed. When crypto prices move down, forced liquidations can accelerate the drop because many positions use margin. Weakening investor confidence and “risk off” mindset means flows out of crypto, less new money coming in. Some parts of the ecosystem are showing strain (market-makers, funds, etc) which raises the chance of further knock-on effects.

Key Reasons for the Drop

- Risk‑off Sentiment & Macro Pressure

Crypto is increasingly behaving like a high‑risk asset. With uncertainty in global markets, investors are pulling back from risk. For example:- Crypto markets fell as tech stocks and other risk assets weakened.

- Weakening expectations for the Federal Reserve to cut interest rates, or fears of further tightening, make non‑yielding assets like crypto less attractive.

- Large‑Scale Liquidations & Leverage

- At the start of the sell‑off, a wave of leveraged positions (used borrowed money) were liquidated, which amplified the downturn.

- As key support levels broke (for both Bitcoin and Ethereum), technical triggers led to further selling.

- Institutional Outflows / Momentum Loss

- Earlier in the year, institutional interest (like ETFs and large funds) helped lift crypto. But now there’s evidence of waning flows, meaning fewer “big buyers” backing the market.

- When big players pull back, markets with already low liquidity (like many crypto markets) get hit harder.

- Technical Breakdown & Liquidity Thinness

- With many traders expecting prices to rise, the break of important support levels triggered stop‑losses and cascade trades.

- With liquidity thin (fewer buyers stepping in), downward moves get exaggerated.

- Loss of Momentum Among Retail & Sentiment Shift

- Sentiment metrics indicate “Extreme Fear” in the crypto market, which means many are hesitant to buy in until clarity returns.

- When both retail and institutional players pause, there’s less support for prices to bounce.

Leave a comment