2025-11-09 K-shaped recovery

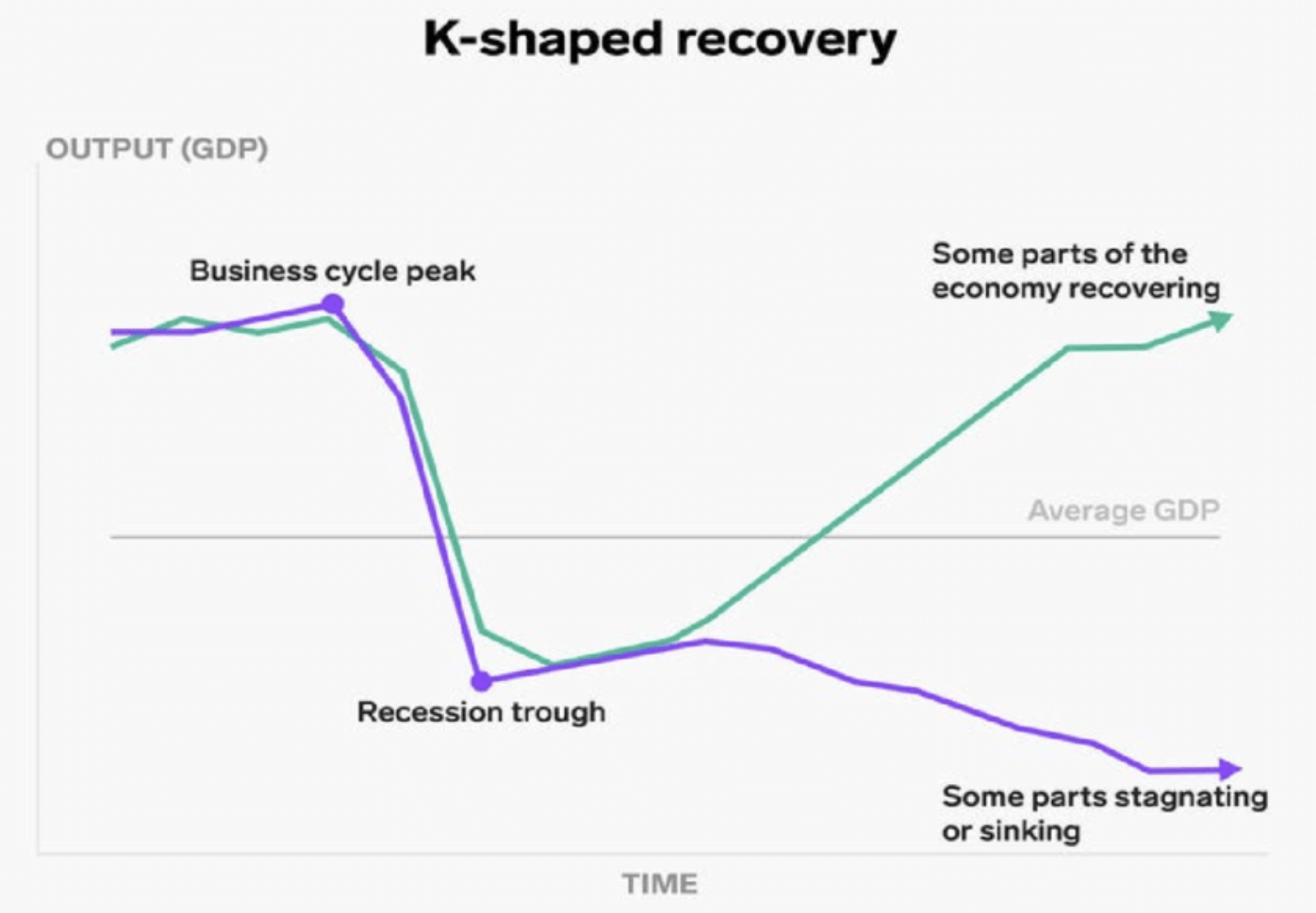

A K-shaped recovery (or economy) is emerging now for a few key reasons — it’s not just one factor, but a combination that’s leading to a very uneven recovery across sectors, people, and assets.

K-shaped recovery

- V-shape + L-shape : together the pattern diverges

- For example, tech, large-corporations, and asset-owners may bounce back quickly; meanwhile, hospitality, travel, small-business may have persistent losses.

- Higher-income worker vs lower income workers

- by region, by type of job, by income bracket

- policy & structural factors : stimulus, monetary and fiscal policy, technological change

U.S. economy news

- real GDP annual rate of 3.8%, beating expectations

- corporate earnings are unusually strong

- marchine learning/AI infrastructure - significant growth driver

- consumer spending, labour market are holding up better than feared

What’s concerning / risks

- underlying weakness - lower income households (softening spending, higher debt burdens)

- government shutdown is costing the economy - $15 billion per week

- slowing momentum

- K-shaped : wealthy households continue benefiting from asset gains, while broad-based strength is less visible.

Leave a comment