2025-11-19 M2 money supply and stock market index

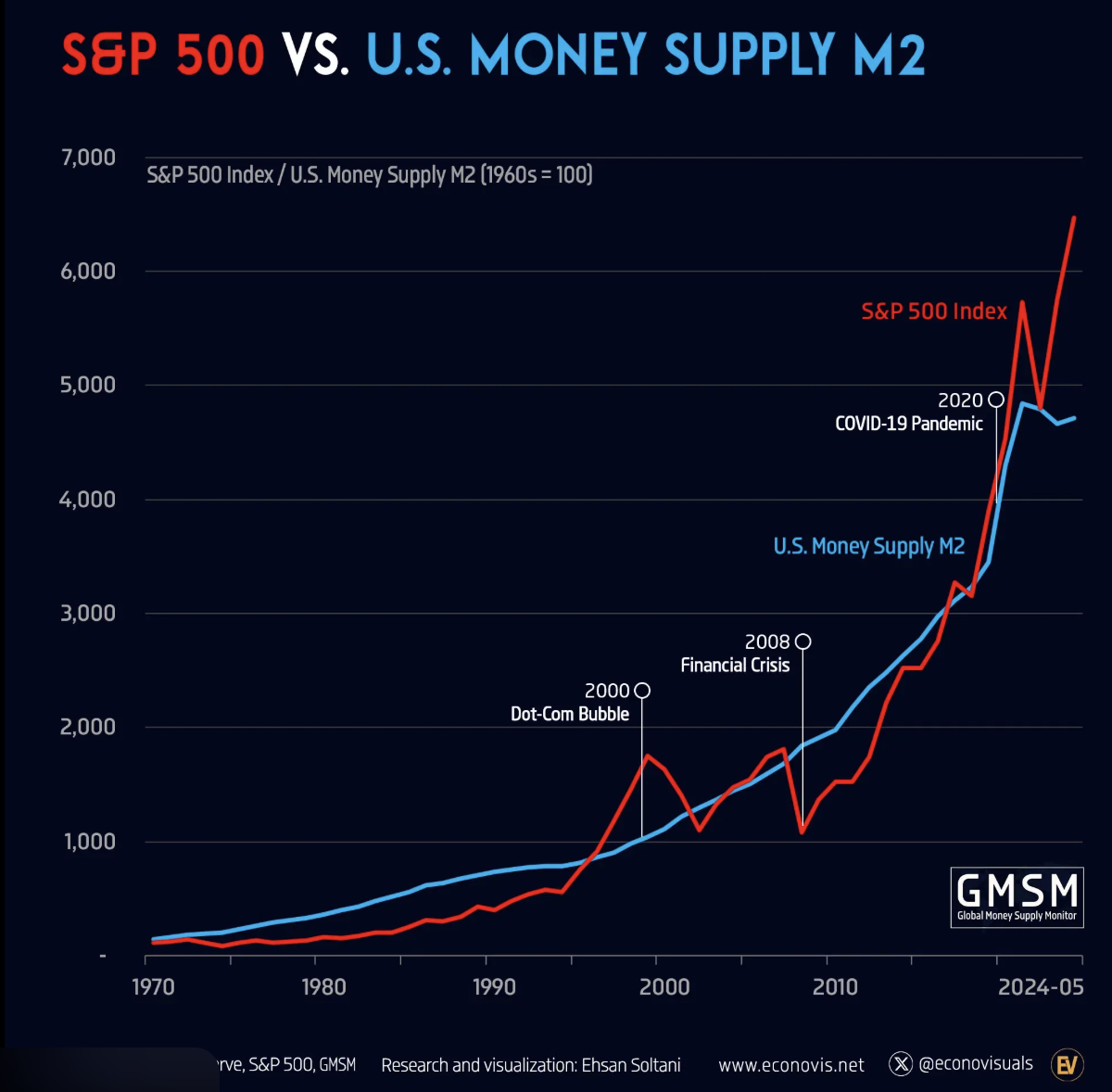

Here are the latest figures and context for the U.S. broad money supply (M2) and a major U.S. stock market index. A falling M2 often signals less liquidity in the system, which can put pressure on consumer spending, lending, investment and ultimately growth.

M2 includes cash, checking deposits, savings deposits, small-time deposits and retail money-market funds.

🧮 M2 Money Supply

- The U.S. M2 money supply is about US$22.21 trillion as of end-September 2025.

- On a monthly basis it rose from ~22.11 trillion in August 2025 to 22.21 trillion in September 2025 (≈ +0.47% month-on-month) and roughly +4.5% year-on-year.

- Seasonally adjusted data show similar levels (e.g., ~22,212.5 billion USD for September 2025) from another source.

Why it matters: M2 is a broad measure of money in circulation (cash + checking + savings + near-money assets) and is often used to assess liquidity, inflation pressures, and potential future economic/market behavior.

📈 U.S. Stock Market Index (Major Benchmark)

- The S&P 500 (a key benchmark for U.S. equities) is currently showing a level around 6,617.32 (data as of 19 Nov 2025).

- For example, MarketWatch lists U.S. market data including major indices like S&P 500 with that closing level.

🔍 How they relate / Why this matters for markets

- A rising M2 suggests increased liquidity in the system, which can support asset prices (including stocks) since more money is available to invest.

- On the flip side, if money supply grows too fast it might fuel inflation, which could lead the Federal Reserve to tighten monetary policy (raising interest rates) and that can put pressure on stocks.

- The current data show moderate growth in M2 (not a dramatic surge) while the stock market benchmark is quite elevated — this combination suggests markets may already be factoring considerable liquidity and optimism.

- Because the S&P 500 level is high, any surprise in monetary policy, inflation data, or money-supply trends (i.e., M2 growth accelerating or decelerating) may trigger stronger market reactions.

Leave a comment